Understanding Real Estate Contracts and Disclosures : A Simple Guide

Today, we’re going to talk about something really important when buying or selling a house: real estate contracts and disclosures. Don’t worry if these words sound complicated – we’re going to break it down so even a 12-year-old could understand it!

Before we dive in, remember that while I’m here to guide you through the real estate process, I’m not an expert in everything. For specific legal advice, you should talk to a real estate attorney. For home inspections, you’ll want a professional home inspector, and for mortgage questions, a mortgage expert is your best bet. As a Realtor, my job is to help you navigate the overall process and connect you with these experts when needed.

What is a Real Estate Contract?

A real estate contract is a written agreement that says:

• Who is selling the house (the seller)

• Who is buying the house (the buyer)

• What house is being sold (the property address)

• How much the buyer will pay for the house (the price)

• When the buyer will get the house (the closing date)

• What things come with the house (like appliances or furniture)

• What needs to happen before the sale is final (like home inspections or getting a mortgage)

Imagine you’re trading baseball cards with your friend. You might shake hands and say, “Okay, I’ll give you my Mickey Mantle card for your Babe Ruth card.” That’s kind of like a verbal contract. But in real estate, we need to write everything down because houses are way more expensive and complicated than baseball cards!

Why are Real Estate Contracts Important?

Real estate contracts are super important because:

• They make sure everyone agrees on what’s happening

• They protect both the buyer and the seller

• They make the deal “official” in the eyes of the law

• They help prevent misunderstandings or arguments later

![]()

Parts of a Real Estate Contract

A real estate contract in Connecticut usually has these parts:

1. Offer and Acceptance: This is where the buyer says, “I want to buy your house for this much money,” and the seller says, “Okay, I agree to sell it to you for that price.”

2. Property Description: This part describes the house and land being sold. It’s like giving someone directions to the house, but with more details.

3. Purchase Price: This is how much the buyer will pay for the house. It’s usually a big number!

4. Earnest Money: This is like a promise from the buyer. They put some money in a special account to show they’re serious about buying the house.

5. Contingencies: These are like “if” statements. For example, “I’ll buy the house if it passes the home inspection” or “I’ll buy the house if I can get a mortgage.”

6. Closing Date: This is the day when the house officially becomes the buyer’s property. It’s like a finish line in a race!

7. Signatures: Both the buyer and seller need to sign the contract to make it official.

What are Disclosures?

Now, let’s talk about disclosures. A disclosure is when the seller tells the buyer important information about the house. It’s like if you were selling your bike and you told the buyer, “Just so you know, the brakes sometimes squeak.”

In Connecticut, sellers have to tell buyers about certain things:

• Property Condition Disclosure: This is a form where the seller answers questions about the house, like:

– How old is the roof?

– Has there ever been a fire in the house?

– Are there any problems with the plumbing or electricity?

• Lead-Based Paint Disclosure: If the house was built before 1978, the seller has to tell the buyer if there’s any lead-based paint in the house. Lead can be harmful, especially to kids, so this is really important!

• Coastal Area Disclosures: If the house is near the ocean, the seller might need to tell the buyer about things like flood risks.

• Smoke and Carbon Monoxide Detectors: The seller needs to say whether the house has working smoke and carbon monoxide detectors.

Why are Disclosures Important?

Disclosures are important because:

• They help the buyer know what they’re getting into

• They protect the seller from being accused of hiding problems later

• They’re required by law in many cases

• They help the buyer decide if they still want to buy the house

Past Insurance Claims

- Transparency is generally recommended: While there’s no specific law requiring disclosure of all insurance claims, being upfront about past issues can help build trust with potential buyers.

- Material facts should be disclosed: If an insurance claim was related to a significant issue that could affect the property’s value or desirability, it’s likely considered a material fact that should be disclosed.

- Repairs matter: If the claim resulted in repairs that fixed the issue completely, disclosing both the claim and the repair can actually reassure buyers that the problem has been professionally addressed.

- Insurance history is accessible: Buyers’ insurance agents can often access information about previous claims on the property. Disclosing this information upfront can prevent surprises later in the process.

- Realtor guidance is valuable: Informing your realtor about past insurance claims allows them to provide better advice on how to handle the disclosure and any potential buyer concerns.

- Liability protection: Disclosing known issues, including past insurance claims, can help protect sellers from future liability if problems arise after the sale.

- Connecticut’s disclosure form: While the standard Connecticut Residential Property Condition Disclosure Report doesn’t specifically ask about insurance claims, it does ask about various conditions that might have led to claims (e.g., water damage, structural issues).

- Consult with professionals: For specific situations, it’s advisable to consult with your realtor and possibly a real estate attorney to determine the best approach to disclosures in your particular case.

Remember, while disclosing past issues might seem counterintuitive when trying to sell a home, transparency can often lead to smoother transactions and reduce the risk of future legal issues.

What Happens After the Contract is Signed?

Once both the buyer and seller sign the contract, a few things happen:

1. The buyer usually puts their earnest money in a special account.

2. The buyer might have a home inspection done to check for any problems with the house.

3. The buyer works on getting their mortgage (if they need one).

4. A title search is done to make sure the seller really owns the house and can sell it.

5. If everything goes well, everyone meets on the closing date to finish the deal.

What if Someone Wants to Cancel the Contract?

Sometimes, things don’t go as planned. Here’s what might happen:

• If the buyer wants to cancel because of something in the contingencies (remember those “if” statements?), they usually can without a problem.

• If the seller wants to cancel, it’s usually much harder unless the buyer didn’t do something they promised in the contract.

• If someone wants to cancel for a reason not in the contract, they might lose money or even be taken to court.

Tips for Understanding Your Real Estate Contract

Tips for Understanding Your Real Estate Contract

1. Read everything carefully: Even if it seems boring, it’s important to know what you’re agreeing to.

2. Ask questions: If you don’t understand something, ask your Realtor or a real estate attorney to explain it.

3. Don’t be afraid to negotiate: If there’s something in the contract you don’t like, you can ask to change it.

4. Get help from experts: Remember, your Realtor can guide you, but for specific legal questions, talk to a real estate attorney.

Frequently Asked Questions about Disclosure Forms

- What happens if a seller fails to provide the required disclosure form?

Answer: If a seller fails to provide the completed Residential Property Condition Disclosure Report to the buyer, they face a $500 fine, payable to the buyer at closing. However, this relatively small penalty does not protect the seller from potential lawsuits if significant undisclosed issues are discovered later.

2. Are sellers required to disclose issues they’re not certain about?

Answer: The Connecticut disclosure form allows sellers to mark items as “Unknown” if they genuinely don’t have knowledge about a particular issue. Sellers are only required to disclose defects or problems they actually know about. However, deliberately marking “Unknown” for issues the seller is aware of could be considered fraudulent. When in doubt, it’s generally better for sellers to err on the side of disclosure to avoid potential legal issues later.

The Ethical Foundation of Real Estate Transactions

While contracts and disclosures form the legal backbone of real estate transactions, professional ethics serve as the moral compass guiding every interaction. As your local Ledyard Realtors, we at Bridget Morrissey Realty, LLC believe that ethical conduct is not just a requirement—it’s the cornerstone of our business.

Why Ethics Matter in Real Estate

In the world of property transactions, ethics go beyond just following the law. They’re about building trust, ensuring fairness, and protecting the interests of all parties involved. When you work with a Realtor who adheres to a strong ethical code, you can feel confident that your interests are being prioritized.

The National Association of REALTORS® (NAR) Code of Ethics

The National Association of REALTORS® (NAR) Code of Ethics

As proud members of NAR, we adhere to a strict Code of Ethics. This code isn’t just a set of guidelines—it’s a commitment we make to our clients and colleagues. Here are a few key points about the NAR Code of Ethics:

- It consists of 17 articles that outline our responsibilities to clients, the public, and other Realtors.

- All Realtors are required to complete ethics training every three years to stay current with best practices.

- The Code ensures we always put our clients’ interests first and cooperate fairly with other real estate professionals.

Ethics in Action

What does ethical conduct look like in real-world transactions? Here are some examples:

- We always provide honest and accurate information about properties, even if it might not be what a client wants to hear.

- We maintain strict confidentiality about our clients’ personal and financial information.

- In cases where we might represent both the buyer and seller (known as dual agency), we ensure all parties are fully informed and agree to this arrangement.

- We continuously educate ourselves about market trends, legal requirements, and industry best practices to provide you with the most up-to-date and accurate guidance.

By prioritizing ethics in every transaction, we not only comply with NAR requirements but also ensure that your home buying or selling experience in Ledyard is as smooth, fair, and transparent as possible. Remember, when you’re dealing with one of the most significant financial decisions of your life, you deserve nothing less than the highest ethical standards from your real estate professional.

Conclusion

Buying or selling a house involves a lot of paperwork, but understanding real estate contracts and disclosures doesn’t have to be super complicated. The most important things to remember are:

• Contracts make the deal official and protect everyone involved.

• Disclosures help the buyer know important information about the house.

• It’s okay to ask for help understanding these documents.

• Your Realtor is here to guide you through the process, but other experts like attorneys, home inspectors, and mortgage professionals play important roles too.

Remember, every house sale is different, so the exact details of your contract and disclosures might vary. But now you have a good basic understanding of what to expect. Happy house hunting!

Frequently Asked Questions

What can I help you with today?

Disclaimer

The information provided in this blog post is for general informational purposes only and does not constitute legal or professional advice. While we strive to keep the information up-to-date and correct, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the information contained in this blog post.

Any reliance you place on such information is strictly at your own risk. Real estate transactions involve complex legal and financial considerations that can vary significantly based on individual circumstances, local laws, and market conditions.

We strongly recommend that readers consult with qualified real estate professionals, attorneys, and financial advisors before making any decisions related to real estate contracts or disclosures. The specific requirements and best practices for contracts and disclosures may change over time and can differ between jurisdictions.

This blog post is not a substitute for professional advice or the ethics training required by the National Association of Realtors (NAR). All Realtors should complete the mandatory NAR ethics course to ensure full compliance with ethical standards in real estate practices.

Bridget Morrissey Realty, LLC and its associates do not assume any liability for actions taken based on the information provided in this blog post.

About the Author

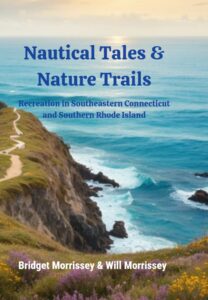

Bridget Morrissey![]() is not just a Realtor but a multifaceted professional dedicated to her community. In addition to her real estate expertise, she’s the author of “Nautical Tales & Nature Trails, Recreation in southeastern Connecticut and southern Rhode Island,” available on Amazon. She also produces the Public Access TV Show of the same name, sharing her passion for local landscapes and communities. Whether you’re looking to sell your home or find your dream property, Bridget Morrissey’s comprehensive approach ensures you receive insightful guidance throughout your real estate journey.

is not just a Realtor but a multifaceted professional dedicated to her community. In addition to her real estate expertise, she’s the author of “Nautical Tales & Nature Trails, Recreation in southeastern Connecticut and southern Rhode Island,” available on Amazon. She also produces the Public Access TV Show of the same name, sharing her passion for local landscapes and communities. Whether you’re looking to sell your home or find your dream property, Bridget Morrissey’s comprehensive approach ensures you receive insightful guidance throughout your real estate journey.