UNDERSTANDING YOUR PRE-FORECLOSURE OPTIONS

A Compassionate Guide for Homeowners

I work with people facing a challenging situation with pre-foreclosure options, and I want you to know that you’re not alone. When homeowners fall behind on payments for at least 90 days, lenders file what’s called a notice of default, beginning what we call “pre-foreclosure.” But please know this: you still have options and time to take action.

What Pre-Foreclosure Means For You

The most important thing to understand is that pre-foreclosure is not the same as foreclosure. You still own your home. You still have control. And you likely have equity worth protecting.

While there is time pressure, you have multiple paths forward, and my role is to help you understand these pre-foreclosure solutions so you can make the best decision for your unique situation.

Options Available To You

Deed in Lieu of Foreclosure

Deed in Lieu of Foreclosure

This option allows you to voluntarily transfer ownership to your lender. The benefits include preventing foreclosure from appearing on your credit report, possible release from remaining debt, and a faster, cleaner break from the property. This requires your lender’s approval, but can be a simpler solution in some cases.

Loan Modification

Loan Modification

Your lender may be willing to give you mortgage default help. Loan modification options can be done by adjusting your loan terms, potentially reducing interest rates, extending the term of your loan, or modifying your payment schedule. This typically requires documented hardship and professional negotiation. I’m happy to refer you to qualified financial and legal professionals who specialize in loan modifications, as this requires specialized expertise.

Short Sale Possibility

Short Sale Possibility

If your home is worth less than what you owe, we may be able to negotiate with your lender to sell the property below the mortgage balance. This preserves your credit better than a foreclosure would, and the process has become more streamlined in recent years. I have the specialized expertise as a short sale Realtor to guide you through this process and ensure we meet all of the timeline requirements.

My Commitment To You

Unlike many realtors who may see your situation as just another listing opportunity, I believe in putting your needs first. My approach is centered on foreclosure prevention by:

- Providing you with all available options

- Listening with empathy to your specific circumstances

- Building trust through education about the process

- Offering genuine solutions that serve your best interests

- Creating a relationship based on respect and understanding

Most importantly, I promise to prioritize what’s best for you, even if that means not listing your home. If another solution serves you better, I’ll guide you in that direction because your well-being matters more than any transaction.

You don’t have to face this situation alone. I’m here to help you navigate these waters with dignity and find the path that best protects your future financial health.

Would you like to discuss homeowner debt relief and explore which options might work best for you? Call or text me at 860-857-5165 to get started.

Frequently Asked Questions

What can I help you with today?

About the Author

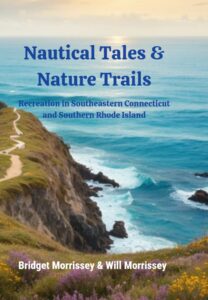

Bridget Morrissey![]() is not just a Short Sale Realtor but a multifaceted professional dedicated to her community. In addition to her real estate expertise, she’s the author of “Nautical Tales & Nature Trails, Recreation in southeastern Connecticut and southern Rhode Island,” available on Amazon. She also produces the Public Access TV Show of the same name, sharing her passion for local landscapes and communities. Whether you’re looking to sell your home or find your dream property, Bridget Morrissey’s comprehensive approach ensures you receive insightful guidance throughout your real estate journey.

is not just a Short Sale Realtor but a multifaceted professional dedicated to her community. In addition to her real estate expertise, she’s the author of “Nautical Tales & Nature Trails, Recreation in southeastern Connecticut and southern Rhode Island,” available on Amazon. She also produces the Public Access TV Show of the same name, sharing her passion for local landscapes and communities. Whether you’re looking to sell your home or find your dream property, Bridget Morrissey’s comprehensive approach ensures you receive insightful guidance throughout your real estate journey.